- Home

- OUR SERVICES

- Pay Now

- About Us

- Contact

Received an income tax certificate? Then submit your tax return now. Get Started Now

- Home

- OUR SERVICES

- Pay Now

- About Us

- Contact

Don’t stress or worry about last-minute ITR filling. Trust our expert –

Income Tax Return (ITR)

Avoid Notices. Get Returns Filed By Expert Chartered Accountants.

Get Free Consultation

HOW WE WORK

Working Process

Connect to a Tax Expert

Submit the required documents

Check the Computation Sheet prepared by Tax Expert

Confirm your Bank Account to receive Refund

ITR Filing Complete

Verify ITR with Aadhar OTP/EVC Code.

HOW WE WORK

Right plan for your business

₹499

Salary & Rental Income

- Salary

- Rent of House Property

- Bank/FD Interest

- Does not Include Business Income

₹1499

Capital Gain Income

- Capital Gain Mutual Fund or Stock

- Capital Gain on Sale of Property

- Gift Cases

- Other Sources

₹2499

Futures and Options

- FnO Trading Income/Loss

- Intraday Trading

- Salary Income

- Capital Gains

₹1999

Business & Profession

- Business with Gross Turnover upto Rs. 45 Lakhs

- Presumptive Taxation Scheme

₹2499

Consultants & Freelancer

- Services with Gross Turnover upto Rs. 45 Lakhs

- Presumptive Taxation Scheme

- Assistance with Refunds

₹4499

Foreign Income

- Income Earned Out of India

- NRE OR NRO Cases

- DTAA Guidance

- RSU/ESOPs

₹2999

Partnership & LLPs ITR

- ITR-5 Filing

- Gross Turnover upto Rs. 45 Lakhs

₹4999

Company ITR

- ITR-6 Filing

- Gross Turnover upto Rs. 45 Lakhs

₹4499

Crypto Currency ITR

- Crypto Income or Loss

Received a Income Tax Notice. File Hassle Free Response with TaxSharks

Received a Income Tax Notice. File Hassle Free Response with TaxSharks (Lead to Form)

- Overview

- Due Date for Filling of ITR

- Documents Required

- Why TaxSharks

- FAQ’s

Income tax filing is the process of reporting income, expenses, and deductions to the government to determine tax liability. It ensures compliance with tax laws and helps individuals and businesses claim eligible refunds or benefits. Taxpayers must file returns annually, disclosing income from salaries, businesses, investments, or other sources. Proper documentation, including income statements, deductions, and tax-saving investments, is essential. Filing can be done online via government portals or through tax professionals. Timely filing avoids penalties and ensures smooth financial planning. With digital advancements, e-filing has made the process faster, more accurate, and convenient for taxpayers.

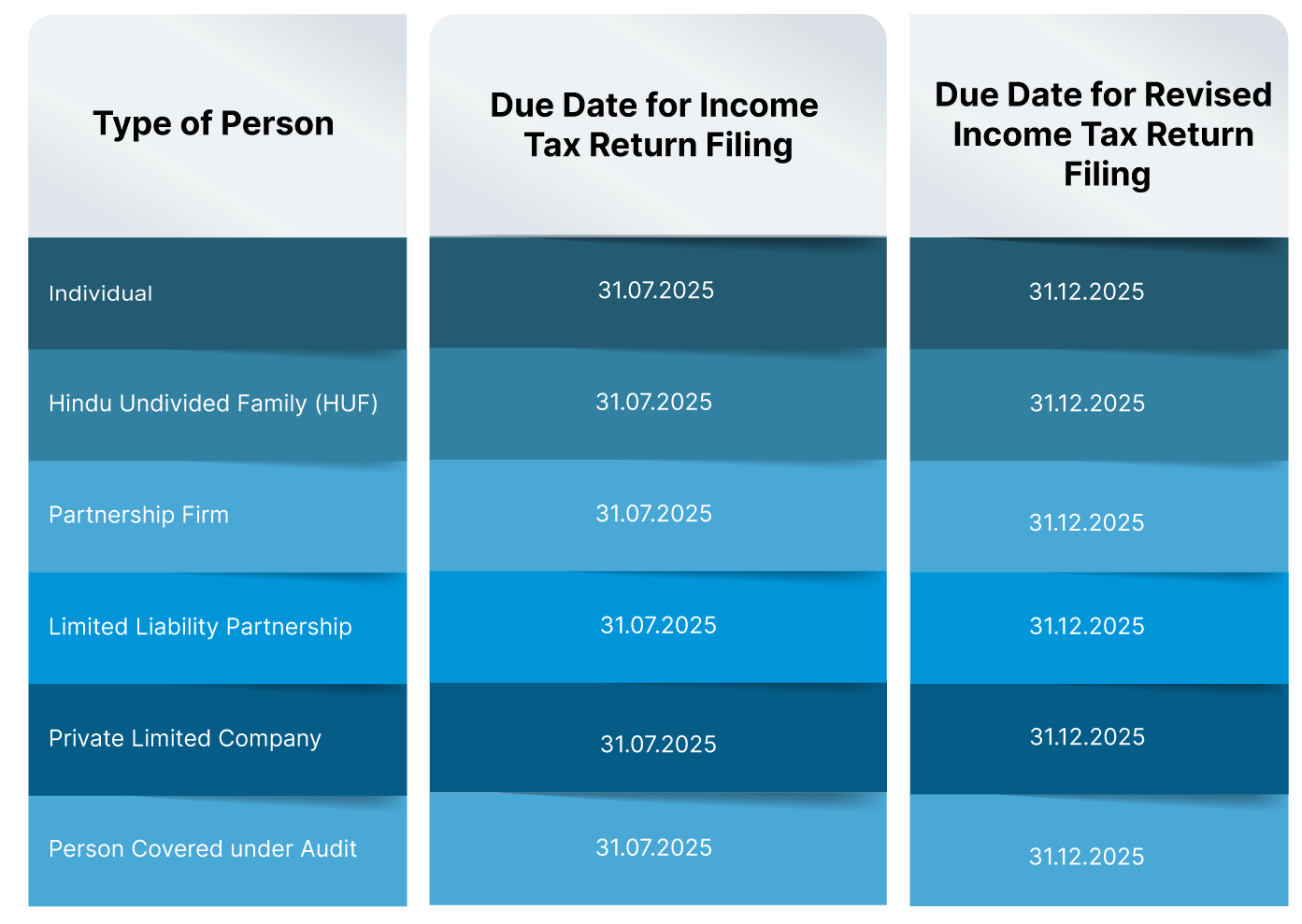

Due Date Of Filing of ITR for Assessment Year 2024-25

Documents Required for Filing Income Tax Return

- In case of salary income, please provide Form 16(PartA &PartB)

- If you have any Shares/Mutual Fund FnO Transactions,Tax PL Statement from Shares/Mutual Fund Broker.

- For any house property given detaill of rent, details of interest and principal repayment in case of a loan for the construction/purchase of that property.

- Details of any profit or gains from business/profession.

- Other source of income during the year, such as interest income, dividend income, lottery income, etc., if any.

- Deduction details which include insurance premiums, mediclaim, tuition fees paid, investment in ELSS, post office, donations, NPS details, EPF/PPF details, etc.

- Please provide your bank account number and IFSC code for refund purpose

- Aadhar & PAN Card Details

Why Taxsharks

TaxSharks is a idea introduced by like-minded professionals understanding the issues & problems faced by small, medium & large businesses. We are team of professionals including Chartered Accountants, Company Secreteries, Lawyers & Consultants, passionate to simplify the taxation & business laws. We aim at providing one on one expert assistance about all your queries assuring satisfaction.

01. What is Income Tax Return (ITR)?

An Income Tax Return (ITR) is a form in which taxpayers declare their taxable income, deductions, and tax payments to the Income Tax Department. It is a legal obligation for individuals and entities whose income exceeds the prescribed threshold.

02. Who is required to file an ITR?

Any individual or entity whose total income exceeds the exempted limit set by the Income Tax Department must file an ITR. This includes individuals, Hindu Undivided Families (HUFs), companies, and firms.

03. What are the different types of ITR forms?

There are several types of ITR forms, including ITR-1 (Sahaj) for salaried individuals, ITR-2 for individuals and HUFs not having income from business or profession, ITR-3 for individuals and HUFs having income from business or profession, ITR-4 (Sugam) for presumptive income from business & profession, ITR-5 for firms, LLPs, etc., ITR-6 for companies, and ITR-7 for entities claiming exemption under sections 139(4A) or 139(4D).

04. How can I file my ITR online?

You can file your ITR online through the e-filing portal of the Income Tax Department. Steps include registering on the portal, selecting the appropriate ITR form, filling in the required details, uploading documents, and submitting the form. Acknowledgment will be generated after successful submission.

05. What documents are needed for filing ITR?

Documents required for filing ITR include Form 16 (for salaried individuals), Form 26AS (tax credit statement), bank statements, investment proofs, interest certificates, rental income receipts, and any other relevant financial documents.

06. What is the process to claim a refund?

If the tax paid exceeds the actual tax liability, you can claim a refund by filing your ITR. The refund is usually credited to your bank account after the ITR is processed. You can check the refund status on the e-filing portal.

07. What is the deadline for filing ITR?

The deadline for filing ITR for individuals is usually July 31st of the assessment year. For businesses requiring audit, it is typically September 30th. These dates can be extended by the Income Tax Department in specific cases.