- Home

- OUR SERVICES

- Pay Now

- About Us

- Contact

Received an income tax certificate? Then submit your tax return now. Get Started Now

- Home

- OUR SERVICES

- Pay Now

- About Us

- Contact

Don’t stress or worry about last-minute ITR filling. Trust our expert –

Annual Compliances For LLP

Get Free Consultation

HOW WE WORK

Working Process

Get Started, Incorporate

Your Business in India.

Expert Advisors available

to answer your

questions

A large pool of CA,CS &

Lawyers (All Over India)

We serve all sectors and

Industries (Scalable)

HOW WE WORK

Right plan for your business

Standard

₹5499/- GOVT FEE

It offers a reliable and cost-effective hosting solution with all the essentials you need to get started.

- Dedicated Accounts Manager

- Form 11 Annual Return

- Form 8 Statement of Solvency

- DIR-3 KYC of Partners

- Annual filing for LLPs having Turnover up to Rs. 20 lakhs)

Additional Feature:

*Notes

Startup Plan

₹8999/- GOVT FEE

It includes a range of advanced features and resources to support and grow your online presence.

- Dedicated Accounts Manager

- Form 11 Annual Return

- Form 8 Statement of Solvency

- DIR-3 KYC of Partners

- GST Filing for One Year

- Income Tax Filing (Up to turnover of 20 lakhs)

- Book Keeping (up to 100 Transactions)

- Preparation of Financial Statements

- Annual filing for LLPs having Turnover up to Rs. 20 lakhs)

Additional Feature:

*Notes

Shark Plan

₹11999/- GOVT FEE

It offers the most robust set of features and resources to ensure the smooth operation and growth of your website.

- Dedicated Accounts Manager

- Form 11 Annual Return

- Form 8 Statement of Solvency

- DIR-3 KYC of Partners

- GST Filing for One Year

- Income Tax Filing (Up to turnover of 20 lakhs)

- Book Keeping (up to 500 Transactions)

- Preparation of Financial Statements

- TDS Compliances and Advance Tax Assessment

- Annual filing for LLPs having Turnover up to Rs. 20 lakhs)

Additional Feature:

*Notes

Not sure about the packages?

Talk to our experts to understand your business compliance

needs and suggest the best plan for you.

needs and suggest the best plan for you.

- Overview

- Annual Compliances for a LLP in India

- Why TaxSharks

- FAQ’s

LLP Annual Compliance - Everything You Need To Know

Annual Compliance for LLP

A Limited Liability Partnership (LLP) is a legal entity governed by the LLP Act of 2008. Consequently, LLPs are obligated to submit annual returns to the Registrar of Companies (ROC) at the end of each financial year. Additionally, LLPs must file an Income Tax Return (ITR) in accordance with the Income Tax Act by the stipulated deadlines. We provides services to file LLP Annual Returns at competitive rates, ensuring accurate and timely submission. Our compliance advisors are always available to assist with any questions you may have.

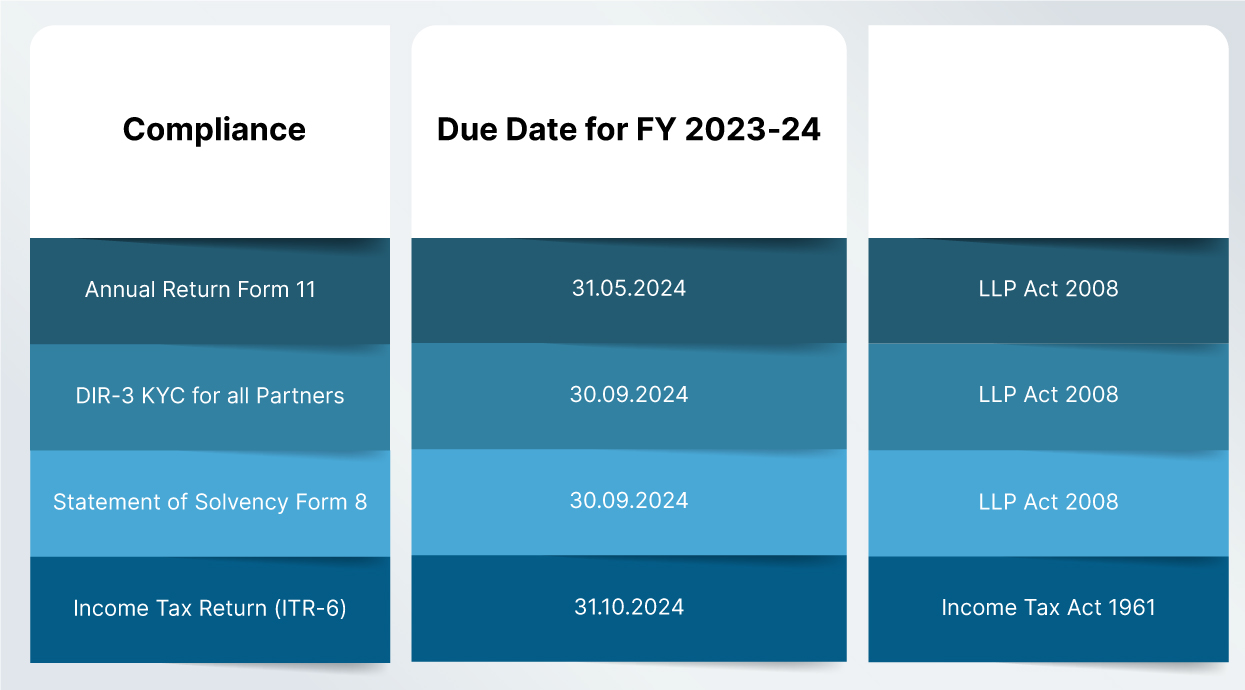

Due Dates

Annual Compliances for a LLP in India

A Limited Liability Partnership (LLP) in India must adhere to several annual compliances to maintain its legal standing and avoid penalties. These include filing various forms with the Registrar of Companies (RoC) and the Income Tax Department. Here is a brief overview of the key annual compliances for an LLP:

Annual Return Filing (Form 11)

Content: Form 11 is a summary of the LLP’s management affairs, including details of partners and their contribution.

Timeline: Must be filed within 60 days from the end of the financial year (by 30th May).

Timeline: Must be filed within 60 days from the end of the financial year (by 30th May).

Statement of Accounts and Solvency (Form 8)

Content: This form includes the LLP’s financial statements, such as the statement of assets and liabilities and the statement of income and expenditure.

Certification: Needs to be signed by the designated partners and certified by a practicing Chartered Accountant/Company Secretary/Cost Accountant.

Timeline: Must be filed within 30 days from the end of six months of the financial year (by 30th October).

Income Tax Return Filing

Form ITR-5: LLPs must file their income tax return using Form ITR-5.

Timeline: By 31st July if audit is not required, and by 30th September if audit is required (subject to any extensions granted by the tax authorities).

Timeline: By 31st July if audit is not required, and by 30th September if audit is required (subject to any extensions granted by the tax authorities).

Audit Requirements

Audit Criteria: An LLP must have its accounts audited if its annual turnover exceeds ₹40 lakh or if its contribution exceeds ₹25 lakh.

Appointment of Auditor: An auditor must be appointed at least 30 days before the end of the financial year.

Appointment of Auditor: An auditor must be appointed at least 30 days before the end of the financial year.

Other Event-Based Compliances

Change in Partners: Filing Form 3 and Form 4 for any addition or removal of partners.

Change in Registered Office: Filing Form 15 for any changes in the registered office address.

Other Changes: Filing appropriate forms for changes in LLP agreement, name, etc.

Change in Registered Office: Filing Form 15 for any changes in the registered office address.

Other Changes: Filing appropriate forms for changes in LLP agreement, name, etc.

Importance of Timely Compliance

Timely compliance with these regulations ensures that the LLP remains in good standing and avoids penalties or legal issues. Non-compliance can result in hefty fines and may affect the LLP’s ability to conduct business smoothly. Engaging professional services can help ensure all filings are accurate and submitted on time.

By adhering to these annual compliances, LLPs can maintain their legal status and avoid penalties, thus ensuring smooth and uninterrupted business operations.

Why Taxsharks

TaxSharks is a idea introduced by like-minded professionals understanding the issues & problems faced by small, medium & large businesses. We are team of professionals including Chartered Accountants, Company Secreteries, Lawyers & Consultants, passionate to simplify the taxation & business laws. We aim at providing one on one expert assistance about all your queries assuring satisfaction.

01. What are the key annual compliance requirements for an LLP in India?

The key annual compliance requirements for an LLP in India include filing the Annual Return (Form 11), Statement of Accounts and Solvency (Form 8), and the Income Tax Return (Form ITR-5). Additionally, LLPs must undergo an audit if their turnover exceeds ₹40 lakh or their contribution exceeds ₹25 lakh.

02. When is the due date for filing the Annual Return (Form 11) for an LLP?

The Annual Return (Form 11) must be filed within 60 days from the end of the financial year, typically by 30th May.

03. What information is required in the Statement of Accounts and Solvency (Form 8)?

The Statement of Accounts and Solvency (Form 8) requires details about the LLP's financial statements, including the statement of assets and liabilities, the statement of income and expenditure, and a declaration on the solvency of the LLP.

04. What is the deadline for filing Form 8 for an LLP?

Form 8 must be filed within 30 days from the end of six months of the financial year, typically by 30th October.

05. Is an LLP required to have its accounts audited?

An LLP is required to have its accounts audited if its annual turnover exceeds ₹40 lakh or if its contribution exceeds ₹25 lakh.

06. What is Form ITR-5 and when should it be filed?

What are the consequences of failing to comply with annual filing requirements for an LLP?

07. What are the consequences of failing to comply with annual filing requirements for an LLP?

Non-compliance with annual filing requirements can result in penalties, fines, and legal consequences. It may also affect the LLP’s legal status and ability to conduct business.

08. How can an LLP change its partners or registered office address?

To change its partners, an LLP must file Form 3 and Form 4. To change its registered office address, it must file Form 15. Any changes in the LLP agreement, name, or other details must be filed using appropriate forms.

09. Who is responsible for signing the Statement of Accounts and Solvency (Form 8)?

The Statement of Accounts and Solvency (Form 8) must be signed by the designated partners and certified by a practicing Chartered Accountant, Company Secretary, or Cost Accountant.

10. Can an LLP hire professional services for compliance management?

Yes, an LLP can hire professional services such as Chartered Accountants, Company Secretaries, or specialized firms to manage compliance. These professionals ensure that all filings are accurate and submitted on time, helping the LLP avoid penalties and legal issues.