- Home

- OUR SERVICES

- Pay Now

- About Us

- Contact

Received an income tax certificate? Then submit your tax return now. Get Started Now

- Home

- OUR SERVICES

- Pay Now

- About Us

- Contact

Don’t stress or worry about last-minute ITR filling. Trust our expert –

Easy Online TDS Return Payment

-

File your TDS/TCS returns on-time and avoid penalties.

E-filing done by Top Accountants and TAX experts - 3 step online process, 100% safe, TDS filed for both businesses and Individuals

Get Free Consultation

HOW WE WORK

Working Process

Get in touch with our experts

Provide Business Information

Filing for TDS Registration

Get your TDSIN

HOW WE WORK

Right plan for your business

Standard

999/- + GOVT FEE

It offers a reliable and cost-effective hosting solution with all the essentials you need to get started.

- Expert Assisted Process

- On Call Consultation

- TDS on Sale of Property Form 26QB Filing

- TDS on Rent Form 26QC Filing

Additional Feature:

*Notes

Startup Plan

1499/- + GOVT FEE

It includes a range of advanced features and resources to support and grow your online presence.

- Expert Assisted Process

- On Call Consultation

- TDS Returns for one Quarter

- Form 24Q/26Q/27Q/27EQ

Additional Feature:

*Notes

Shark Plan

4999/- + GOVT FEE

It offers the most robust set of features and resources to ensure the smooth operation and growth of your website.

- Expert Assisted Process

- On Call Consultation

- TDS Returns Filing for four Quarters

- Form 24Q/26Q/27Q/27EQ

- Form 16/16A Generation

Additional Feature:

*Notes

Not sure about the packages?

Talk to our experts to understand your business compliance

needs and suggest the best plan for you.

needs and suggest the best plan for you.

- Overview

- Types of TDS returns

- TDS Returns?

- TDS return filling

- Why TaxSharks

Tax Deducted at Source (TDS) and Tax Collected at Source (TCS) are two tax collection methods in India. The deductor collects TDS from the payee at the time of payment for certain specified payments. The collector collects TCS from the seller of certain specified goods or services at the time of sale.

Who must submit e-TDS/TCS statements?

All persons responsible for deducting or collecting tax at source must submit e-TDS/TCS statements. This includes:

Employers who deduct tax on salary payments

Banks who deduct tax on interest payments

Individuals who deduct tax on rent payments

Companies that collect tax on payments made to contractors

Types of TDS returns

Form 24Q

This form is to be filled in respect to a tax deduction on payment of employee salary. This return is to be filed by all the employers in India.

Form 26Q

This form is to be filled in respect to tax deductions on transactions other than payment of salary, such as on rent, professional fees, interests, dividends, payment to contractors etc.

Form 26QB

The purpose of this form filing TDS Returns with regard to a deduction on income from the sale of immovable property in India.

Form 27Q

The purpose of filing of this type of return is to furnish details of the transactions in respect to the foreign payments made.

Form 27EQ

TCS Return is filed with respect to the tax collection at source on transactions such as sale of liquor, tendu leaves, scrap sales, timber, etc.

Why should you timely file your TDS Returns?

To avoid the penalty

penalty No doubt, late filing of the TDS/TCS return would attract a heavy penalty of INR 200 per day till default continues.

To prevent additional penalty

Besides the minimum penalty of INR 200, the tax deductor would also be liable for the additional penalty for failure to file TDS return within one year from the particular date. This ranges from INR 10,000 to INR 1 lakh.

To facilitate reconciliation of the ITR

The main purpose of the filing of TDS return is reconciling of the income actually earned with income declared in the income tax return.

To avoid cancellation of the expenditure

If the person supposed to file the TDS return fails to do so on time, then the assessing officer may opt for nullifying the impact of expenditure on which the TDS was required to be deducted but not deducted. Hence liable for incremental tax incidence.

Facilitating filling of Form 26AS

Form 26AS is annual consolidated tax statement that specifies the details of the taxes deducted during the year. Anyone can claim TDS credit only if entries is visible in form 26AS. If you deduct the TDS of a person and not file TDS return, such person may rush to you for the same at last moment.

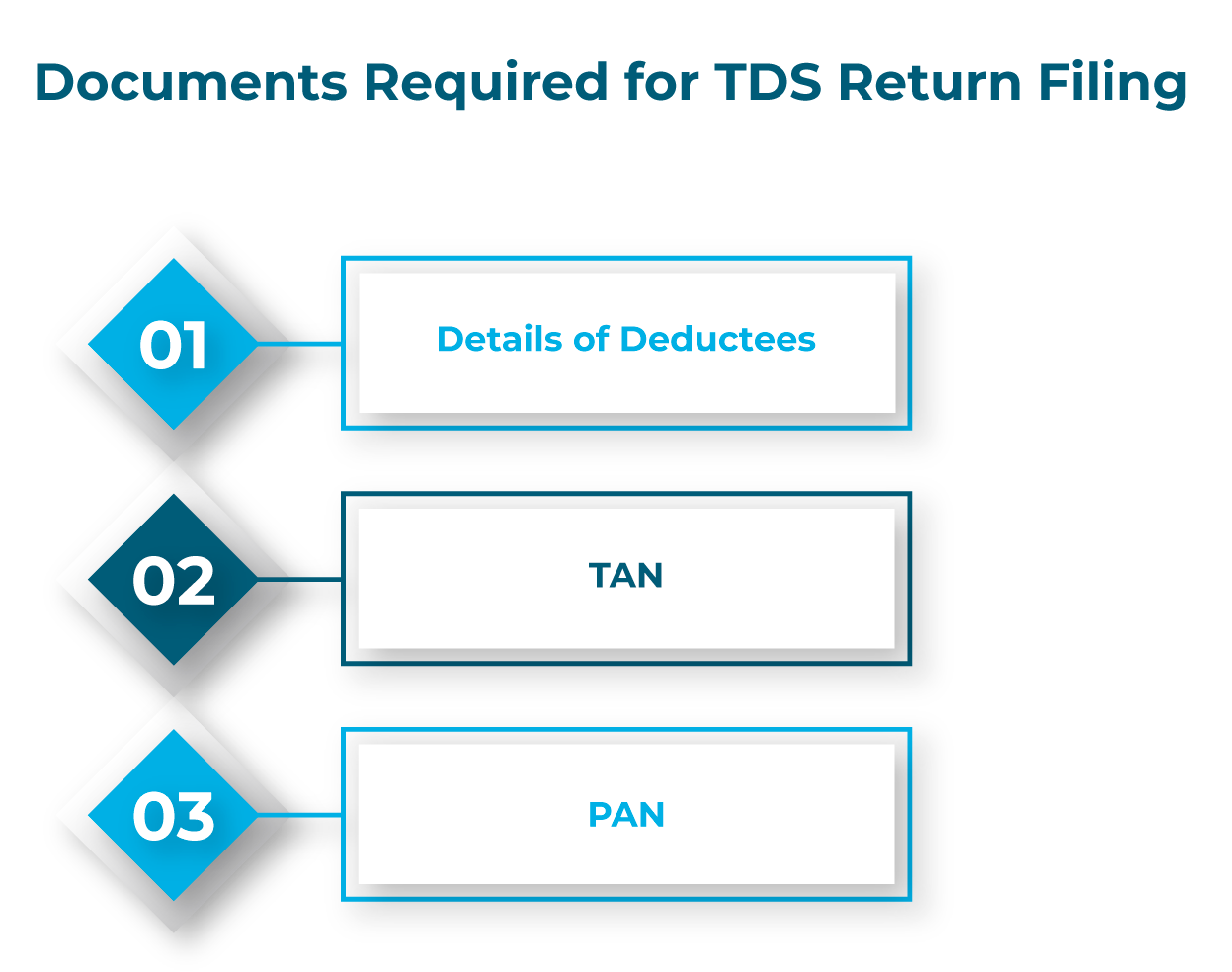

Process of TDS return filling

Upload the Required details and documents for filing TDS return on our web portal.

Upload the Required details and documents for filing TDS return on our web portal.

On placing the order, your application will be assigned to one of our dedicated professionals

Our professional team will prepare TDS return and provide you the statement for approval.

Once approved, our professional will file TDS return online.

An Acknowledgement Receipt of TDS return shall be provided to you over the email.

Why Taxsharks

TaxSharks is a idea introduced by like-minded professionals understanding the issues & problems faced by small, medium & large businesses. We are team of professionals including Chartered Accountants, Company Secreteries, Lawyers & Consultants, passionate to simplify the taxation & business laws. We aim at providing one on one expert assistance about all your queries assuring satisfaction.