- Home

- OUR SERVICES

- Pay Now

- About Us

- Contact

Received an income tax certificate? Then submit your tax return now. Get Started Now

- Home

- OUR SERVICES

- Pay Now

- About Us

- Contact

Don’t stress or worry about last-minute ITR filling. Trust our expert –

GST Registration Online

-

Simple process for new GST registration, application status tracking,

and filing for clarifications -

Tailored services for GST needs of citizens, eCommerce sellers,

and government offices

Get Free Consultation

HOW WE WORK

Working Process

Get in touch with our experts

Provide Business Information

Filing for GST Registration

Get your GSTIN

HOW WE WORK

Right plan for your business

GST Registration

₹499/-Per Month

Upgrade your social portfolio with a stunning profile & enhanced shots.

- Application for GST Registration

- Application for Clarification

- Multiple images & videos

- Basic customer support

- Featured ads

- Special ads badge

GST Return Filing

₹5499/- Yearly

Upgrade your social portfolio with a stunning profile & enhanced shots.

- GSTR-1 Return Filing

- GSTR-3B Return Filing

- Credit Reconciliation

- Basic customer support

- Featured ads

- Special ads badge

GST QRMP

₹3499/- Yearly

Upgrade your social portfolio with a stunning profile & enhanced shots.

- GSTR-1 Return Filing

- GSTR-3B Return Filing

- Multiple images & videos

- Basic customer support

- Featured ads

- Special ads badge

GST Composition Dealers

₹3999/- Yearly

Upgrade your social portfolio with a stunning profile & enhanced shots.

- CMP-08 for 4 Quarters

- Application for Clarification

- Multiple images & videos

- Basic customer support

- Featured ads

- Special ads badge

GST Annual Return

₹7499/- Yearly

Upgrade your social portfolio with a stunning profile & enhanced shots.

- GSTR-9 Annual Return

- GSTR-9C Reconciliation Statement

- Credit Reconciliation

- Basic customer support

- Featured ads

- Special ads badge

GST LUT Filing

₹1499/- Yearly

Upgrade your social portfolio with a stunning profile & enhanced shots.

- LUT Filing

- Application for Clarification

- Multiple images & videos

- Basic customer support

- Featured ads

- Special ads badge

Received a Income Tax Notice. File Hassle Free Response with TaxSharks (Lead to Form)

Received a Income Tax Notice. File Hassle Free Response with TaxSharks (Lead to Form)

- Overview

- Documents Required

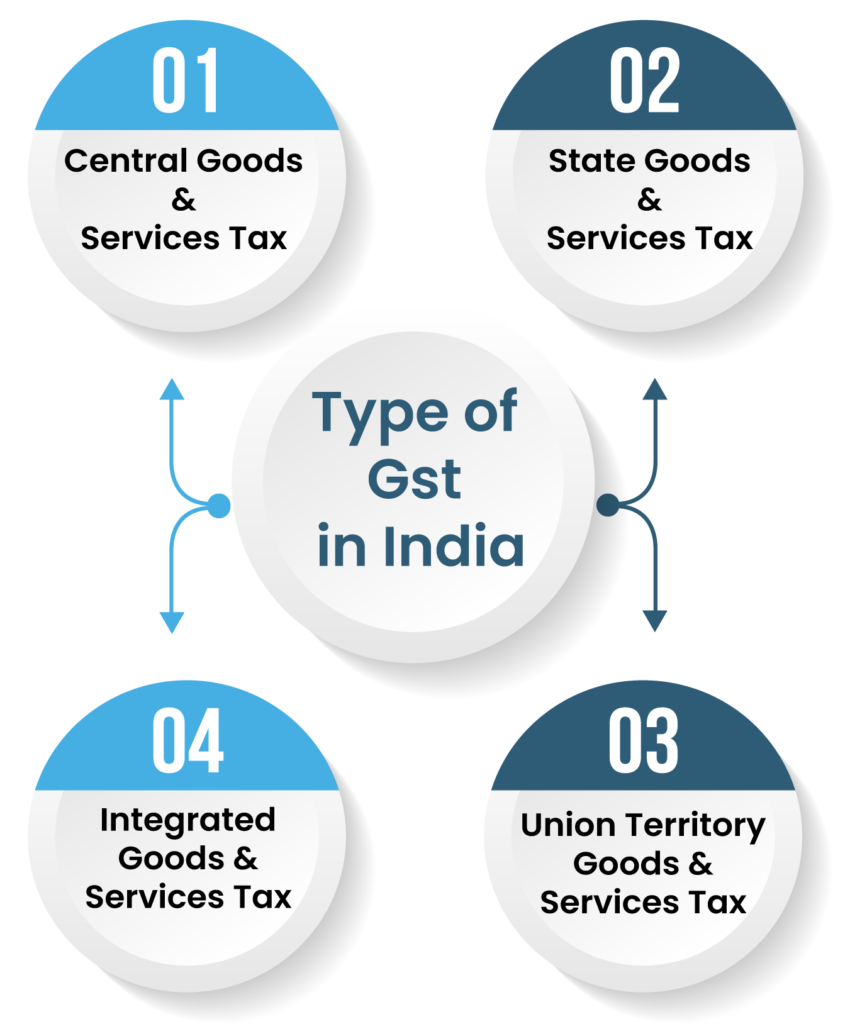

- Type of GST

- Benefits

- Why TaxSharks

GST Registration

GST registration is the process of obtaining a unique identification number for a business liable to pay Goods and Services Tax (GST). As per the Central Goods and Service Tax Act of 2017, businesses with an annual turnover of more than ₹40 lakh (or ₹20 lakh for some special category states) must register as normal taxable entities. In India, a GSTIN (Goods and Services Tax Identification Number), commonly known as a GST number, consists of 15 digits. These digits are unique to each taxpayer and serve as their identification under the GST regime. This identification number helps to share all the operations and data related to the transactions with authorities.

GST or Goods and Service Tax is a destination-based, multi-stage, indirect tax system. It substitutes for VAT and other collective taxes. GST registration refers to the process of registering a firm under the GST Act of 2017. Under the GST regime, any business required to pay service tax, excise duty, VAT, or central excise must register for Goods and Service Tax (GST). GST registration is mandatory for all eCommerce sellers. Citizens can apply for a new GST online without needing to visit a government office. The registration process can be initiated on the GST portal. Upon submission of the GST application, the portal will immediately generate an ARN status.

Documents Required for GST Registration

The following documents are required for the new registration process.

- Applicant's PAN

- Aadhaar card

- Evidence of business registration or Incorporation certificate

- Promoters/Director's Identity and Address proof with Photographs

- Business location Address proof

- Electricity bill and utility bill of the office address

- Digital Signature Certificate

- Letter of Authorisation or Board Resolution for Authorised Signatory

Benefits of Registering for GST

Why Taxsharks

TaxSharks is a idea introduced by like-minded professionals understanding the issues & problems faced by small, medium & large businesses. We are team of professionals including Chartered Accountants, Company Secreteries, Lawyers & Consultants, passionate to simplify the taxation & business laws. We aim at providing one on one expert assistance about all your queries assuring satisfaction.