- Home

- OUR SERVICES

- Pay Now

- About Us

- Contact

Received an income tax certificate? Then submit your tax return now. Get Started Now

- Home

- OUR SERVICES

- Pay Now

- About Us

- Contact

Don’t stress or worry about last-minute ITR filling. Trust our expert –

Annual Compliances For

Private Limited Company

Get Free Consultation

HOW WE WORK

Working Process

Get Started, Incorporate

Your Business in India.

Expert Advisors available

to answer your

questions

A large pool of CA,CS &

Lawyers (All Over India)

We serve all sectors and

Industries (Scalable)

HOW WE WORK

Right plan for your business

Standard

₹11999 ₹8999 + GOVT FEE

It offers a reliable and cost-effective hosting solution with all the essentials you need to get started.

- Dedicated Accounts Manager

- Auditor Appointment ADT-1

- INC-20A Commencement of Business

- Director KYC

- Book Keeping (up to 100 Transactions)

- Preparation of Financial Statements

- AOC-4 Filing of Financials to ROC

- Annual filing(Upto turnover of 20 lakhs)

Additional Feature:

*Notes

Startup Plan

₹14999 ₹11999 + GOVT FEE

It includes a range of advanced features and resources to support and grow your online presence.

- Dedicated Accounts Manager

- Auditor Appointment ADT-1

- INC-20A Commencement of Business

- Director KYC

- Book Keeping (up to 100 Transactions)

- Preparation of Financial Statements

- AOC-4 Filing of Financials to ROC

- MGT-7 Annual Return

- Annual filing(Upto turnover of 20 lakhs)

- GST Filing for One Year

- Income Tax Filing (Up to turnover of 20 lakhs)

Additional Feature:

*Notes

Shark Plan

₹18999 ₹15199 + GOVT FEE

It offers the most robust set of features and resources to ensure the smooth operation and growth of your website.

- Dedicated Accounts Manager

- Auditor Appointment ADT-1

- INC-20A Commencement of Business

- Director KYC

- Book Keeping (up to 100 Transactions)

- Preparation of Financial Statements

- AOC-4 Filing of Financials to ROC

- MGT-7 Annual Return

- Annual filing(Upto turnover of 20 lakhs)

- GST Filing for One Year

- Income Tax Filing (Up to turnover of 20 lakhs)

- PF/ESIC Compliances (Upto 5 Employees)

- TDS Compliances and Advance Tax Assessment

Additional Feature:

*Notes

Not sure about the packages?

Talk to our experts to understand your business compliance

needs and suggest the best plan for you.

needs and suggest the best plan for you.

- Overview

- Checklist of Compliances

- Why TaxSharks

- FAQ’s

Everything you need to know

Annual Compliance for Private Limited Company

Annual compliances for a Private Limited Company in India refer to the mandatory filings and regulatory requirements that must be fulfilled each year to remain in good standing with legal and regulatory authorities. These compliance obligations apply regardless of the company’s turnover or capital amount. Ensuring compliance with the Registrar of Companies (ROC) is mandatory for all registered private limited companies. Failure to meet these annual compliance requirements can lead to severe consequences.

All private limited companies, one-person companies, limited companies, and section 8 companies are required to adhere to annual compliance regulations as per the Companies Act of 2013. These compliances ensure that the company operates transparently, maintains accurate records, and adheres to statutory regulations. Here’s a brief meaning of the key annual compliances:

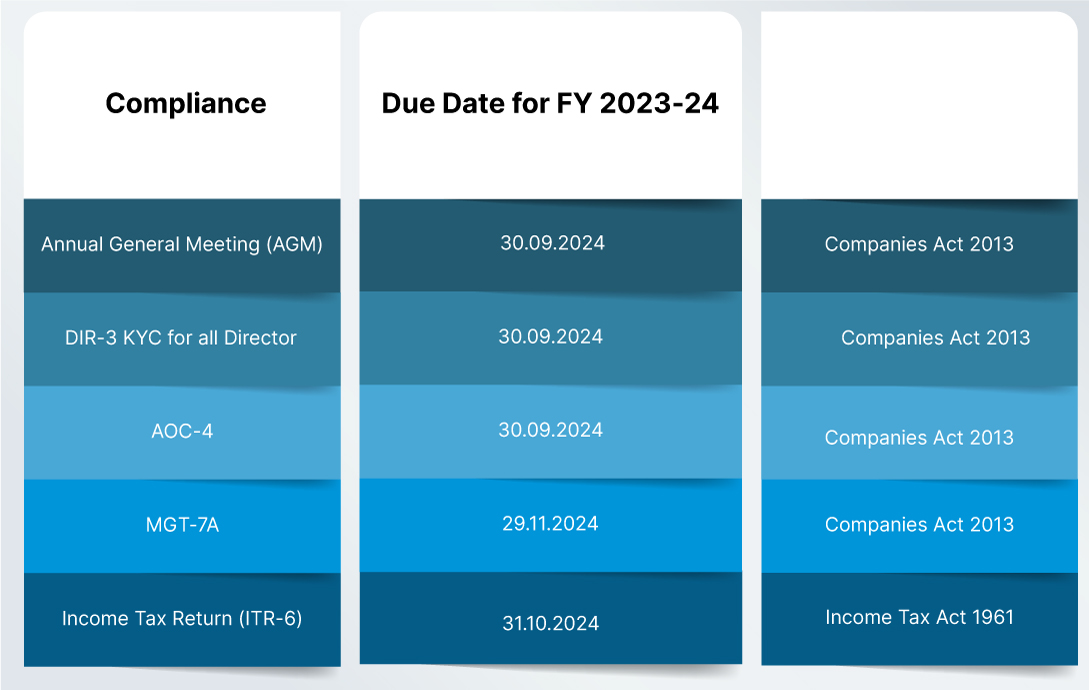

Due Dates

Annual General Meeting (AGM)

Timeline: Must be held within six months from the end of the financial year (by 30th September).

Purpose: To present the financial statements and address any other business that may come up.

Purpose: To present the financial statements and address any other business that may come up.

Financial Statements Filing

Form AOC-4: This form needs to be filed with the Registrar of Companies (RoC) for the submission of the financial statements.

Timeline: Within 30 days from the date of the AGM.

Timeline: Within 30 days from the date of the AGM.

Annual Return Filing

Form MGT-7: An annual return that contains details about the company’s directors, shareholders, and other related information.

Timeline: Within 60 days from the date of the AGM

Timeline: Within 60 days from the date of the AGM

Income Tax Return Filing

Form ITR-6: To be filed with the Income Tax Department.

Timeline: Typically by 30th September of the assessment year (subject to any extensions provided by the tax authorities).

Timeline: Typically by 30th September of the assessment year (subject to any extensions provided by the tax authorities).

Board Meetings

Frequency: At least four board meetings should be held in a year, with a maximum gap of 120 days between two consecutive meetings.

Minutes: Proper records of the minutes of the meetings need to be maintained.

Minutes: Proper records of the minutes of the meetings need to be maintained.

Director’s Report

Content:The report should contain details of the company’s performance, financial status, and other significant information.

Approval: Should be approved by the Board of Directors before it is signed and submitted.

Approval: Should be approved by the Board of Directors before it is signed and submitted.

Intimation of Auditor Appointment

The annual general meetings are held to conduct four activities, such as approval of financial statements, declaration of dividend appointment of directors, and consider the auditor’s appointment or reappointment. Form ADT-1 is a prescribed form for filing intimation to the ROC about appointments or changes in the company’s statutory auditor. Within 15 days of the conclusion of the AGM, you must file form ADT-1 with the ROC. If delayed, it can be filed with an additional fee.

Statutory Audit

Appointment of Auditor: Every company must appoint an auditor within 30 days from the date of incorporation.

Audit of Financial Statements: The company’s financial statements must be audited by a qualified Chartered Accountant.

Audit of Financial Statements: The company’s financial statements must be audited by a qualified Chartered Accountant.

Director KYC

Form DIR-3 KYC: All directors need to complete the KYC (Know Your Customer) process annually.

Timeline: By 30th September each year

Timeline: By 30th September each year

MSME Form (If Applicable)

Form MSME-1: To be filed bi-annually by companies that deal with Micro, Small, and Medium Enterprises, detailing payments due to such enterprises.

Timeline: For the period from April to September, it should be filed by 31st October, and for October to March, it should be filed by 30th April

Timeline: For the period from April to September, it should be filed by 31st October, and for October to March, it should be filed by 30th April

Other Event-Based Compliances

Change in Directors: Filing of DIR-12 for any appointment or resignation of directors.

Change in Registered Office: Filing of INC-22.

Increase in Authorized Share Capital: Filing of SH-7.

Allotment of Shares: Filing of PAS-3.

Change in Registered Office: Filing of INC-22.

Increase in Authorized Share Capital: Filing of SH-7.

Allotment of Shares: Filing of PAS-3.

Why Taxsharks

TaxSharks is a idea introduced by like-minded professionals understanding the issues & problems faced by small, medium & large businesses. We are team of professionals including Chartered Accountants, Company Secreteries, Lawyers & Consultants, passionate to simplify the taxation & business laws. We aim at providing one on one expert assistance about all your queries assuring satisfaction.

01. What is the significance of annual compliances for a private limited company?

Annual compliances ensure that a private limited company operates transparently, maintains accurate records, and adheres to statutory regulations set by the Companies Act of 2013. Non-compliance can result in penalties and legal consequences.

02. What is the deadline for holding the Annual General Meeting (AGM)?

The AGM must be held within six months from the end of the financial year, typically by 30th September.

03. What documents are required to be filed with the Registrar of Companies (RoC) annually?

Key documents include the financial statements (Form AOC-4), the annual return (Form MGT-7), and the auditor's report.

04. What is Form AOC-4?

Form AOC-4 is used for filing the financial statements, including the balance sheet, profit and loss account, and auditor's report, with the RoC. It must be filed within 30 days of the AGM

05. What is Form MGT-7?

Form MGT-7 is the annual return that provides details about the company's directors, shareholders, and other key information. It must be filed within 60 days of the AGM.

06. What is the consequence of not filing annual compliances on time?

Failure to file annual compliances on time can lead to penalties, fines, and legal actions against the company and its directors. The company’s status may also be marked as non-compliant or struck off the register.

07. What are the requirements for income tax return filing for a private limited company?

Private limited companies must file their income tax returns using Form ITR-6, typically by 30th September of the assessment year, unless an extension is granted by the tax authorities.

08. How many board meetings are required annually for a private limited company?

At least four board meetings must be held each year, with a maximum gap of 120 days between two consecutive meetings.

09. What is Director KYC and its deadline?

Director KYC involves verifying the identity of the company’s directors through Form DIR-3 KYC. This process must be completed annually by 30th September.

10. Are there specific compliances for companies dealing with MSMEs?

Yes, companies dealing with Micro, Small, and Medium Enterprises (MSMEs) must file Form MSME-1 bi-annually, detailing payments due to such enterprises. The filing deadlines are 31st October for the period from April to September, and 30th April for the period from October to March.